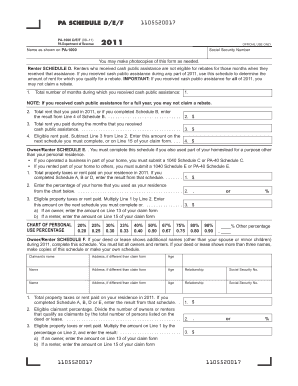

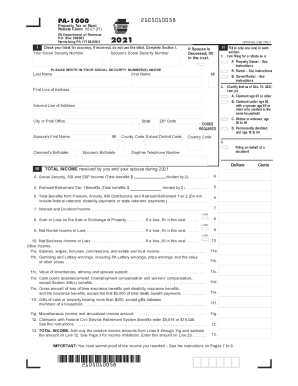

Get the free rental rebate application

Show details

.revenue.pa.gov ... As a result of Act 156 of 2014, income increases due solely to ... MIT a copy of one of the following documents as proof of ... You are eligible for a Property Tax/Rent Rebate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rent rebate application form

Edit your rent rebate form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rent rebate forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rental rebate form online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pa rent rebate form 2025 pdf download. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pdffiller form

How to fill out rent rebate:

01

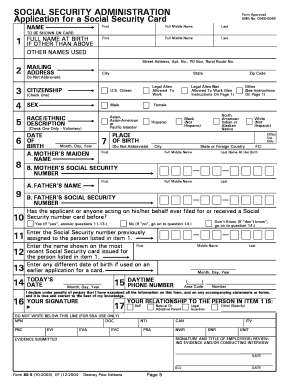

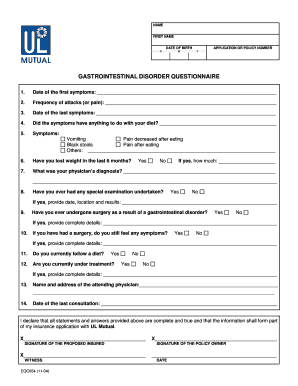

Gather necessary documents such as proof of rent payment, income documentation, and identification.

02

Obtain the rent rebate application form either online or from your local government office.

03

Carefully read and follow the instructions provided on the application form.

04

Fill out the personal information section including your name, address, and contact details.

05

Provide accurate information about your rental property, such as the landlord's name and address.

06

Submit proof of rent payment, which may include rent receipts, lease agreement, or other relevant documents.

07

Provide income documentation such as pay stubs, bank statements, or tax returns to determine eligibility.

08

Review the completed application form for accuracy and ensure all required sections are adequately filled.

09

Sign and date the application form as required and attach any additional supporting documents.

10

Submit the completed application form and supporting documents according to the specified submission method.

Who needs rent rebate:

01

Individuals or families with low to moderate incomes who are struggling to afford their rent payments.

02

Tenants who meet the eligibility criteria set by their local government or housing authority.

03

Individuals who reside in regions or jurisdictions that offer rent rebate or financial assistance programs.

04

Renters who are paying a significant portion of their income towards rent and may benefit from financial relief.

05

People who are facing financial hardships or unexpected circumstances that make it difficult to pay their rent.

Fill

rent rebate pa application

: Try Risk Free

People Also Ask about pa property tax rebate form

Is the IRS sending out 500 dollars?

Eligible individuals with adjusted gross income up to $75,000 will automatically receive the full $1,200 payment. Eligible married couples filing a joint return with adjusted gross income up to $150,000 will automatically receive the full $2,400 payment. Parents also get $500 for each eligible child under 17.

Are Canadians getting $500?

Thanks to the NDP's use of its power in the Liberal minority government, there is now a one-time $500 benefit available to low-income renters across Canada. The deadline to apply is March 31, 2023.

Are Canadian getting extra money 2022?

As of July 2022, if you receive OAS you will be getting a 10% increase to your existing benefits, as long as you are 75 or older. This can work out to an extra $800 per year for those who receive a full pension.

Who gets the $500 from the federal government?

Amount of the credit If your net income for 2021 was $100,000 or less, you will receive a $500 tax credit. If your net income for 2021 was more than $100,000 but less than $105,000, the $500 will be reduced by 10% of the part of your net income that exceeds $100,000.

What is the senior stimulus program 2023?

While there is no actual stimulus, there are supplementary grocery benefits available via the Food Assistance for Older Adults programs via medicare advantage plans, that can provide up to $900 for seniors in qualified groceries.

Who qualifies for the Canada Housing Benefit?

WHO IS ELIGIBLE? In order to be eligible, applicants must have an adjusted net income in 2021 of $35,000 or less for families or $20,000 or less for individuals. The applicants must also pay at least 30 per cent of their adjusted family net income towards rent in the 2022 calendar year.

Who is eligible for the Economic Impact payment?

Who is eligible? U.S. citizens, permanent residents or qualifying resident aliens may qualify for the maximum amount of $1,200 for an individual or $2,400 for married individuals filing a joint return.

What is the $500 payment Canada?

The one-time top-up to the Canada Housing Benefit aims to help low-income renters with the cost of renting. You may be eligible for a tax-free one-time payment of $500 if your income and the amount that you pay on rent qualify.

What is the $300 federal payment Canada?

This payment is a tax-free amount that is designed to help individuals and families with the cost of federal pollution pricing. It has a basic amount as well as a supplement amount for people who live in small and rural communities.

Who qualifies for the senior stimulus check?

California: California will be giving payments of up $700 for joint filing couples earning less than $150,000 annually, with individuals qualifying for up to $350.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify pa 1000 rc form without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your pennsylvania rent rebate application into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find where can i get a rent rebate application?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific pa rent rebate form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my pa rent rebate rent certificate in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your renters rebate form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is rent rebate?

A rent rebate is a financial assistance program designed to help eligible individuals, mainly low-income tenants, by providing them with a rebate on a portion of their rent payments.

Who is required to file rent rebate?

Typically, individuals who are tenants and meet specific income and eligibility criteria set by local or state programs are required to file for a rent rebate.

How to fill out rent rebate?

To fill out a rent rebate application, individuals must complete the required forms provided by the local or state housing authority, include necessary income and rental information, and submit any required documentation by the specified deadline.

What is the purpose of rent rebate?

The purpose of rent rebate is to alleviate financial burdens on low-income tenants, helping them afford housing by reimbursing a portion of their rent.

What information must be reported on rent rebate?

When filing for a rent rebate, individuals must report information such as their total annual income, the amount of rent paid, the addresses of the rental properties, and any other requested financial details.

Fill out your rental rebate application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Renters Rebate Application is not the form you're looking for?Search for another form here.

Keywords relevant to pa property tax rebate

Related to pennsylvania property tax rent rebate program

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.