Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Rent rebate is a scheme in which a tenant is given a partial or full refund of rent paid. This rebate may be provided by the landlord, the government, or other organizations. The amount of rebate varies from one situation to another. Generally, the tenant must have met certain criteria to be eligible for the rebate, such as occupying the property for a certain period of time, and not having an outstanding balance on rent payments.

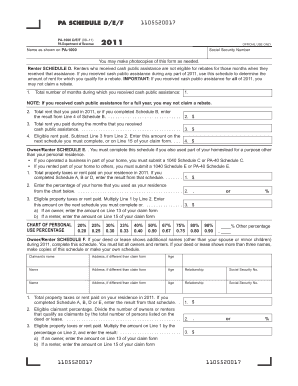

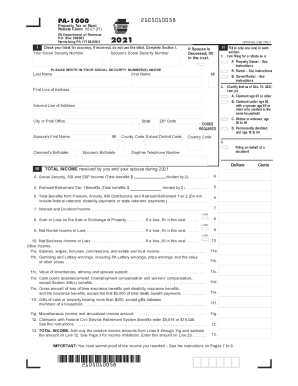

Who is required to file rent rebate?

The state of Pennsylvania requires all renters who pay rent in the state to file for a rent rebate. To qualify, renters must have an income of less than $35,000 and must have paid rent during the calendar year.

What is the purpose of rent rebate?

Rent rebate is a form of financial assistance for individuals who are struggling to make ends meet. It provides a one-time payment, usually in the form of a check, to help cover rent, utilities, and other housing-related costs. It is intended to assist those who may be at risk of eviction or homelessness due to their inability to pay rent.

When is the deadline to file rent rebate in 2023?

The deadline to file rent rebate in 2023 has not yet been determined. Generally, the deadline to file rent rebate is in mid-May of the following year.

How to fill out rent rebate?

To fill out a rent rebate, you will typically need to follow these steps:

1. Gather your documents: Collect all necessary documentation, such as your lease agreement, proof of rent paid, and any other documents required by your local housing authority.

2. Review eligibility requirements: Check the eligibility criteria for the rent rebate program to ensure that you meet the income and other requirements.

3. Obtain the application form: Obtain the official rent rebate application form from your local housing authority or the relevant government website. You may be able to download and print the form directly from the website.

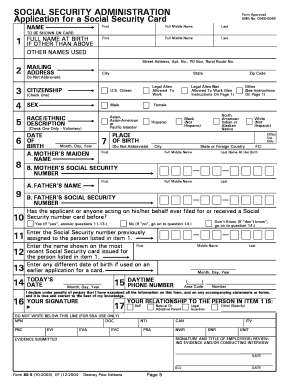

4. Fill out personal information: Start by filling out your personal details, such as your name, address, contact information, and social security number. Make sure to include any additional information requested, such as the number of dependents in your household.

5. Provide income information: Fill in the details of your income, including your wages, pensions, and any other sources of income. Be sure to accurately report all income as requested.

6. Report rent and expenses: Provide information about your rental property, such as the address, landlord's name, and rental amount. Include any expenses, such as utilities and property taxes, if applicable.

7. Attach supporting documentation: Attach copies of the required supporting documents, such as your lease agreement, rent receipts, and income verification documents. Ensure that you make copies for your records.

8. Review and double-check: Review your completed application form to ensure that all the information provided is accurate and complete. Double-check for any errors or omissions before submitting the form.

9. Submit the application: Deliver your completed application and supporting documents as instructed on the form. This may involve mailing them or filing them in person at the designated office. Make sure to meet any application deadlines specified.

10. Follow up: After submitting the application, keep a record of any confirmation or reference numbers provided. You may want to follow up with the housing authority in a few weeks to check on the status of your application and inquire about the expected processing time.

Note: The specific requirements and process may vary depending on your location and the specific rent rebate program you are applying for. It is recommended to consult the official instructions and guidelines provided by your local housing authority or government agency for accurate information and instructions.

What information must be reported on rent rebate?

The specific information that must be reported on a rent rebate may vary depending on the jurisdiction and applicable tax laws. However, some common information that is typically required to be reported on a rent rebate includes:

1. Tenant's personal information: This includes the name, address, social security number or taxpayer identification number of the individual or individuals who received the rent rebate.

2. Landlord's information: The name and address of the landlord or property management company who provided the rent rebate.

3. Rental property details: The address, unit or apartment number, and other relevant details of the rental property for which the rebate is being claimed.

4. Amount of rent rebate: The total amount of rent received as a rebate or refund.

5. Tax year: The year in which the rent rebate was received.

It is important to consult with a tax professional or review the specific guidelines provided by the tax authorities in your jurisdiction to ensure compliance with the reporting requirements for rent rebates.

What is the penalty for the late filing of rent rebate?

The penalty for late filing of a rent rebate can vary depending on the specific jurisdiction and applicable laws. In some cases, there may be a specific fee or penalty assessed for each day the filing is late, while in other cases it may be a flat fee or a percentage of the rebate amount. It is advisable to consult the relevant local authorities or the specific program guidelines to determine the exact penalty for late filing.

How can I modify rent rebate without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your pa rent rebate form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find rent rebate status?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific pa1000 form and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my pa 1000 form 2021 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your rent rebate pa form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.